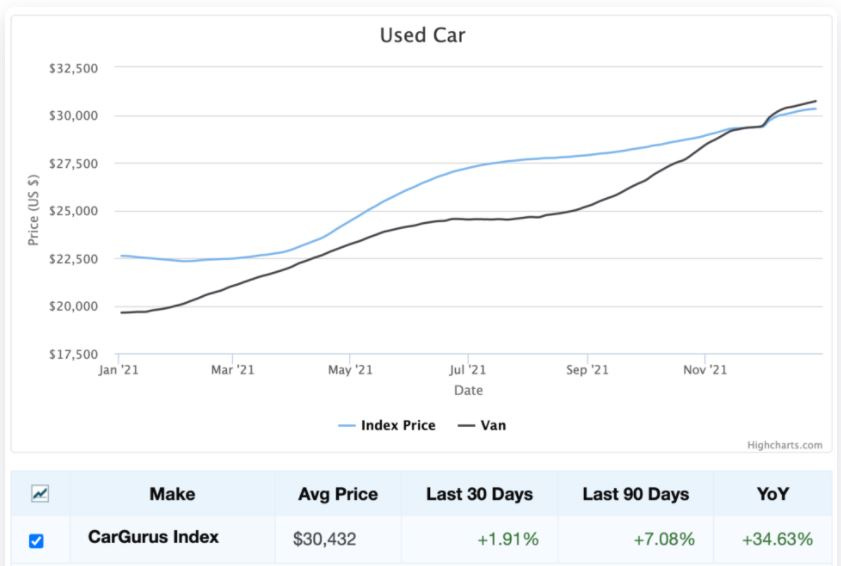

I am routinely talking to industry leaders in person and on industry blog sites trying to get a temperature check on how dealers are feeling across the country and internationally. Specifically, I am interested in their thinking around future outlooks and their most significant challenges. Invariably, over the last 23 months, the discussion always comes back to the overall new and used supply, the wholesale market, and the price of used cars. A big question is how long will used cars stay high and how long will consumers have an appetite for these rising vehicle costs. With the average used vehicle eclipsing $30,000*, that is a very legitimate question. However, consumers' intent to purchase a vehicle in the next six months is higher than a year ago. For more on that topic, go to my article here from last week:

Let's focus our time here on New Car supply and how that will impact 2022 retail sales and consumer purchase behavior. While no one has a crystal ball, it looks like new car manufacturers, with the help of chip manufacturers, are signaling what they anticipate for the coming year. Unfortunately, that signal is another very tough supply-side market.

The inventory constraints are impacting multiple areas of the auto industry. Rental car companies are holding on to their fleet supply which will hinder used-car inventory in the next three to four years, further inflating prices. Just recently, the GlobalFoundries CEO: said, "we are sold out of semiconductor chip capacity through 2023." The median inventory of semiconductor products highlighted by buyers has fallen from 40 days in 2019 to less than five days in 2021, and according to an interview on Jan 26th with the US Commerce Secretary, Gina Raimondo, "the semiconductor shortage has reached a crisis level." The outlook for new cars is uncertain for 2022 thus far. In that light, we must again focus on a used car strategy to keep the 2021 momentum going in 2022. With all these factors in play, the new supply might not grow much from last year until the supply chain issues are resolved. That could take a couple of years, at least. I hope I am wrong.

The question is, knowing that we will see some level of new car supply growth in 2022 drawing in the new car pent-up demand, are we at risk of becoming over-leveraged in our used car investment? That is not possible in my opinion, and I will give you three reasons why:

There are plenty of buyers on the sidelines whose cars are aging and will need to replace them with quality used vehicles in the next 12 months. That is why demand will remain stable to strong in 2022.

As new cars get sold and more retail-ready used inventory hits the market, commercial players will go after it like hawks waiting on their turn for new car allocation. That will keep used values strong for some time.

The day supply of used inventory is aging and growing in mileage. Most of that inventory will filter out, possibly to buy-here-pay-here dealers as newer used vehicles hit the market through new car trades. That should clean out our day supply with newer used cars but will show little to no overall change throughout the year in overall retail-ready day supply.

All of this points back to the title of this blog. First, you should continue to have a wholesale safety net throughout 2022 for the reasons outlined above. Second, new Cars will come back, but day supply is littered with old inventory that needs to be flushed out before used cars will see any significant value decline. Third, pent-up demand is still on the sidelines but expected to get into the game in 2022. Finally, commercial players are expected to be down another 15% this year in volume, which will require them to go after used inventory throughout 2022, keeping the prices stable to high. Happy selling!

*