The latest NADA study reveals the success model

Used Sales and Service will lead the way to continued profitability in 2023

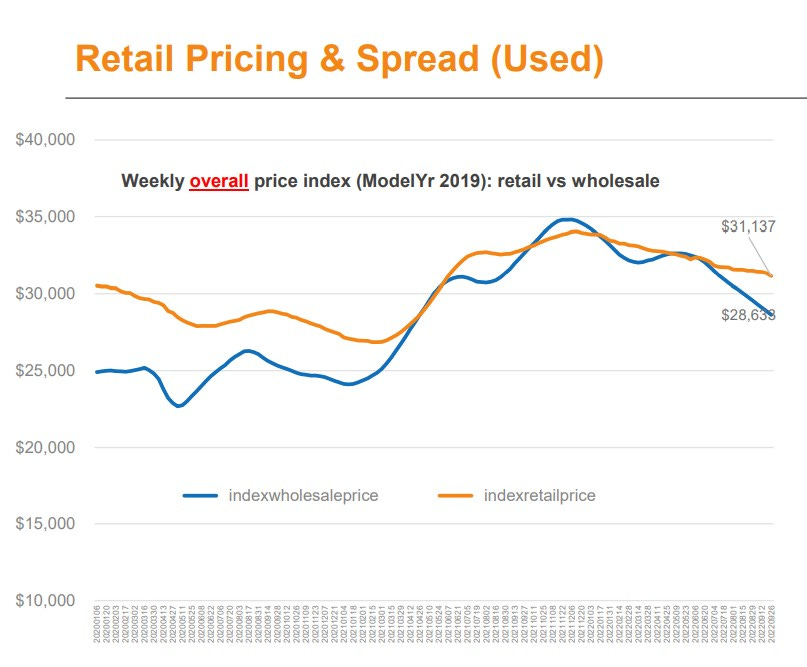

Automotive Market Overview: Consumer sentiment moved lower this week and will likely fall further with rates jumping, stocks declining, and gas prices ticking up again. The job market remains strong, but new initial claims are increasing. Retail vehicle sales continue to be limited in the new market with tight supply and record prices with little incentives. The used market has returned to average days' supply, but wholesale prices have declined more than average for this time of year. You can see the wholesale decline in blue and the slower retail softening in orange, which presents profit potential.

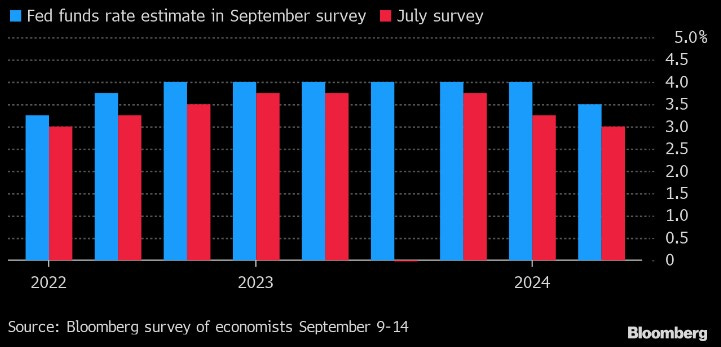

Lower prices should create more buying opportunities, but so far, retail prices are not coming down as rapidly as wholesale. Higher interest rates have reduced affordability, especially for lower-income and lower credit quality segments, and rates are headed much higher given the Fed's plans to fight inflation, as shown above. Keep an eye on the Fed's actions for the remainder of the year and how that impacts retail prices, pent-up demand, and consumer sentiment to determine strategy.

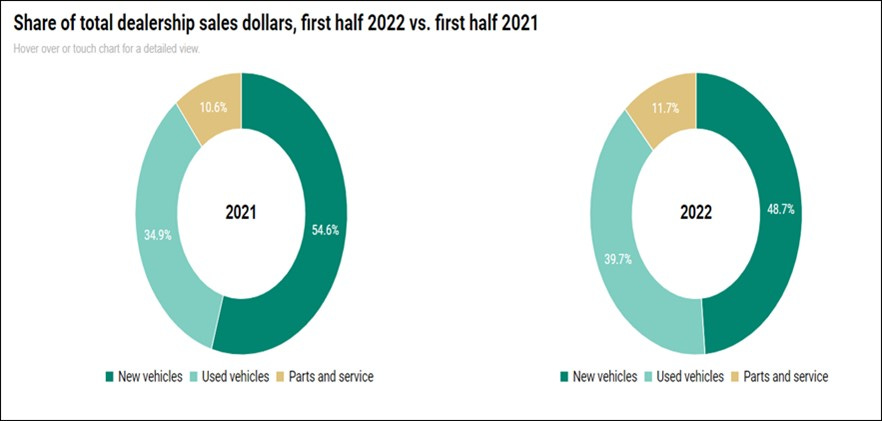

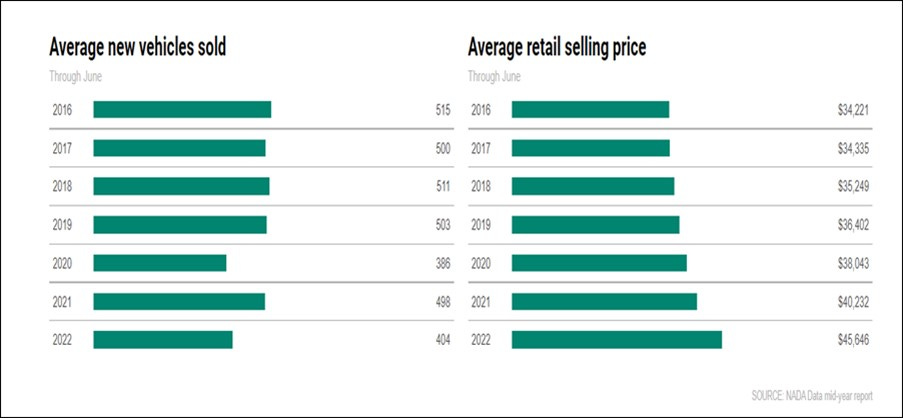

Dealership's first half Results: As reported by a NADA study this week, the automotive industry is undoubtedly headed into a softer second half of the year, but the future is still promising. NADA data shows that while new and used-vehicle sales are down through the first half of the year, demand for both sales and service remains high. Dealers relied more on selling used vehicles and repairing cars through the first half of 2022 more than they had the year before. As the microchip crisis constrained new-vehicle production, the share of dealership revenue obtained from new-vehicle sales sunk below the 50 percent mark. As you can see below, the dollars have shifted due to supply constraints that have put more emphasis on used and service.

The Study: Car dealers having a good 2022, NADA data show | Automotive News (autonews.com)

What does it tell us: Based on the study's findings and following what we have been saying, demand is still strong, and the outlook is not doomed for the second half of the year going into the tax season. Indeed, the dollars are shifted from new cars to used cars and services and we will continue to see that trend for some time. Investing in those departments and increasing efficiencies through acquisition and reconditioning process improvements will be crucial to continued profitability. Studying your inventory management system and following the metrics in these graphs will help you determine the best approach to assess your dealership’s inventory set and retail strategy for the second half of 2022 and into 2023.

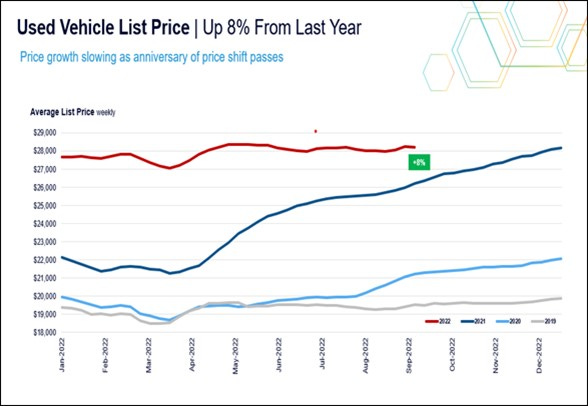

Used Vehicle Market: This week, Automotive news stated that Used-vehicle pricing remains high but may begin to moderate as wholesale prices have dropped in recent months, Menzi said. That could cause some dealers to adjust how much they pay to acquire used vehicles and how they price them, he added. In addition, sourcing used cars also have a challenge. After two years of low supply of new vehicles, we're now starting to feel the effects of lower availability of late model used cars, which is typically what franchised dealers specialize in," Menzi said.

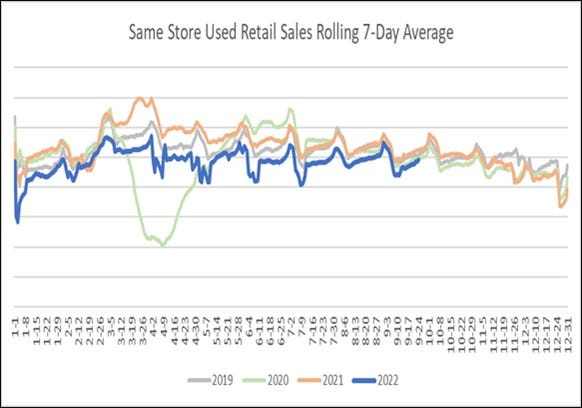

Used Vehicle Sales vs. Price: The used vehicle sales rate has been steady and on a consistent trajectory with 2019. Past performance can indicate future results if the prior year’s behavior is normal, but it isn't. Our best benchmark year is 2019, but the industry has changed in dynamic ways that make even that hard to predict. We must be aware of this and keep a keen eye on the weekly trends to try to envision a future forecast.

What do the trends show: Looking closer at the seven-day rolling average throughout 2022, it matches the 2019 trajectory with consistent month-over-month behavior seen below. That can indicate how the rest of the year may perform in the used market. Taking these trends and insights into account and doing some analysis, it may be reasonable to suspect that you can project your sales forecast out for the rest of the year. Consider the approach of following the 2019 trend line, understanding that the retail price will stay steady to moderately declining for the rest of the year. A moderate decline in sales price can be a good thing as it should motivate the sideline buyer who has been waiting to see any reduction in the price point.

What is the opportunity: To prove that for your specific market and dealership, you can go back and compare your sales performance to the market over the last 10 months to determine how accurate your trend is to the rolling 7-day sales graph above. That can be evidence of how you use this data in setting your day supply to an anticipated sales rate. Finally, the used vehicle list price is up 8% from last year and staying steady even with the softening of demand which helps to stabilize budgets and offset water in your aged inventory with a first-in / first-out approach.

Final Thoughts: The market will be volatile for the next term due to many factors. However, by watching the correct data points that show consumers' behavior and sentiment along with industry supply and demand trends, you may be able to predict the subsequent actions to take market share and grow volume and profits.