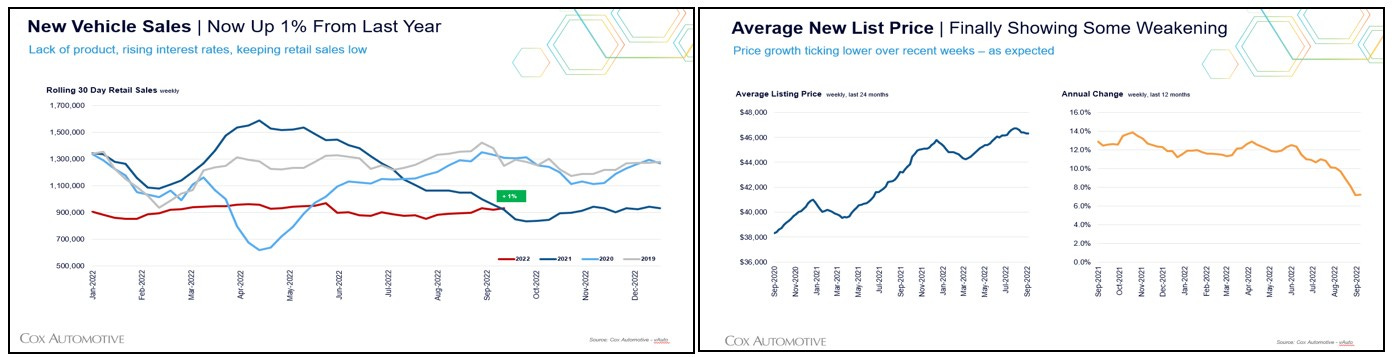

This week the automotive view is pretty good. The sales and supply were up for both new and used this week, but the bigger story may be that the sales pace is holding. In addition, recent interest rate hikes could potentially stifle vehicle sales as monthly payments are forced higher. However, the data suggests new and used recent rate hikes have NOT impacted sales as sales appear to show slight gains in both markets.

Listening to industry insider’s guidance and looking at the vehicle sales, we can see the steady state in the graphs above from January through today. The average list price in new vehicles increased exponentially quarter over quarter and sits around $46,000 today. However, since June 2022, prices have softened some, which hasn't changed the stability of the sales shown in both graphs. Vehicle price growth has dropped 21%, but the sales price is stable. The sales performance should continue for the remainder of the year due to the supply constraint. However, it will be interesting to see what the pricing side will do after the next round of OEM projected volume announcements. Currently, it is a very manageable market for the consumer and the dealer.

Used vehicle sales have steadily increased since August, as seen above, following 2019. In late September and moving into October, we can see an uptick in used sales while list prices stayed steady with some slight declines in the rate of growth. I was speaking to a dealer this week, and their question was how impactful the drop-in rate of change of used prices was, and the answer is substantial in that it brings stabilization to the market. However, as you can see by the list price being over 28,000 that it is still not a buyers' market, and the proper inventory for the right buyer is the secret sauce.

Even better news shown above is the gap between wholesale and retail costs still has significant continued profit potential for every first-in, first-out retail unit sold. Looking at the graphs, you can also see that non-luxury has the most profit potential versus luxury, and that's been the case all year. Based on vehicle supply, this is an opportunity for dealers to flip inventory with profitable vehicles while keeping a sharp eye on other areas of opportunity by segment in their customer base.

Happy Selling

John Ellis, The BEV Guy

Could it be the reason price spreads from wholesale and retail staying steady is from dealers holding their aged inventory up not willing to bite the bullet and move the unit and not being willing to accept the loss?

Great info John!