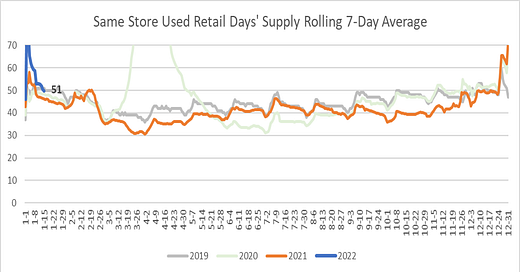

Our industry felt the impact of retail sales being weaker than expected in December, as the Omicron wave of COVID-19 and early holiday purchasing delivered disappointing sales for the month. However, the effects of those weaker sales were used vehicle day supply rising in December, hitting 51 for the first time since January 2021 according to Cox Automotive Inc. Still, days’ supply at the end of December was nearly four days below the December 2020 level. So, it is not your dealership’s mismanagement of inventory; it is simply a result of a soft December and January. Supply is up across the board as seen just below. But that is about to change, so be ready for it.

The good news is the forecast is for a solid tax season with a spring bounce. The guidance is, don't panic and sell-off. Instead, manage your inventory day supply knowing you will need that inventory to match an accelerated sales rate mid to late Feb through April, maybe even May. One way of taking advantage of this soft market over the next couple of weeks is to find deals where you can flip that aged inventory, right-size your cost basis, and prepare for the pent-up demand surge. Below is an example of how you can sell your aging vans for the above MMR and purchase crossovers for less than MMR. That’s the kind of flip I am suggesting while keeping the needed day supply levels, even if slightly elevated currently. Work with your inventory partners to choose the right strategy for your dealership and your market.

If you think the forecast is wrong, that the economy is trending down and will continue, then look at this chart below. That is just not the case. Every economic category is strong, and the market is ready for a Tax Season/Spring demand surge.

If you think consumers are getting tired of these inflated prices, and even if they wanted a car couldn’t afford it, you would be wrong. The car deal is sweeter for them now than it has been in the last seven years. It is better to buy a used vehicle with a trade today than in 2019. You can see that clearly below showing the difference between the selling price (yellow) and the trade-in value (gray). The gap is smaller now than in the last seven years. So again, it favors the buyer now more than ever. Make sure your salespeople know this and reference this in every car deal they make. This will get more of those invisible, “I don’t have one”, trades to pop up magically as well.

Finally, if you think that customers won’t have the means to buy or credit to buy at these prices, think again. The graphs below show buyers have pent-up money to match that pent-up demand with plenty of credit available to them. The top graph is how much credit is available in the market and as you can see it’s over 100% and the bottom is the average deposit account accumulated saving still in consumers bank accounts today. They have the money.

Consumers, as with each new year, are looking for their tax estimate before pulling the trigger, which happens in a few weeks. They may be getting a few dollars less due to child tax credit advances, but they have the saving as you can see above to make that up. They also don’t want to wait and pay higher interest rates later in the year.

The guidance here is to manage your cost basis in this soft market. Work with your inventory partners to find a strategy to acquire fresh inventory in this soft aquisition market at a day supply that will meet the coming sales rate. This strategy will keep you from having to panic-buy inventory, and overpay, like we saw many dealer having to do last year at this time.