New cars won't save the day just yet.

Disruptions are still constraining supply and bolstering used car price.

Good morning. As a reminder, you can hear the audio version of my weekly email HERE.

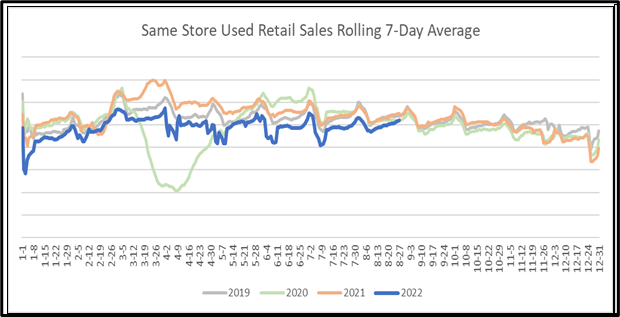

This week we continue seeing average used car price growth after it had been ticking lower for months. The new market is now starting to follow with a 10% price growth this week. That is not surprising with news out last week of Asian market heat waves hindering manufacturing as reported HERE. North American auto plants are cutting an additional 59,100 vehicles from automakers’ global production plans because of the ongoing microchip shortage, according to the latest report from AutoForecast Solution. With the increase in prices and the slight incline in retail sales over the last few weeks (seen below in the blue line), I am still firm on used cars holding their value and possibly increasing in wholesale values late Q3 and into Q4, preparing for Q1-2023 sales.

Just this morning, I posted an article on LinkedIn about Chengdu, the capital of Sichuan province, locking down its 21 million residents to contain a Covid-19 outbreak (pictured at the top). Depending on the duration of the lockdown, electronics and automaker supply chains are at risk of even more disruption. You can read that article HERE. All this news tells us, as in the last two years, new cars are not coming to save the day just yet.

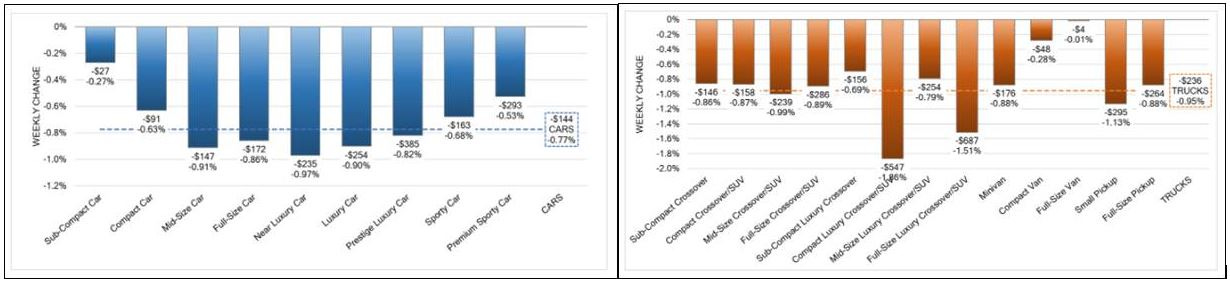

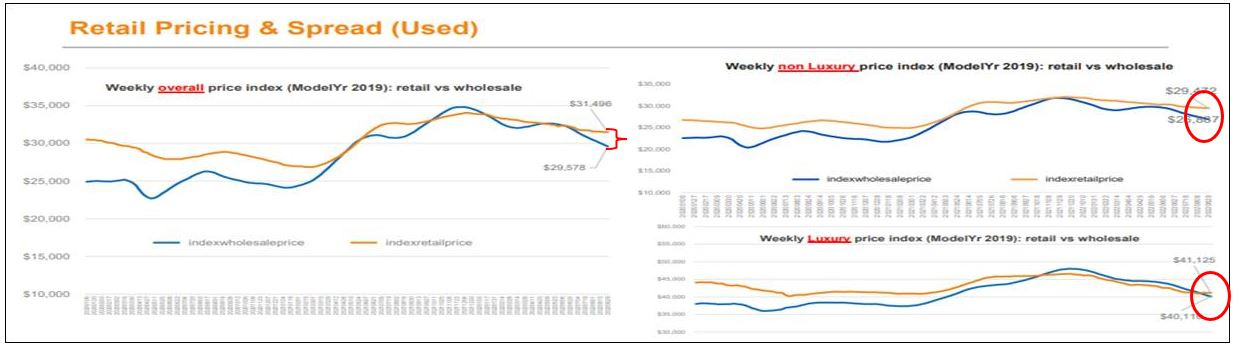

Considering that new supply news, prices for used inventory could rise again this year. If you look just above, you can see buying opportunities in wholesale lanes to acquire the inventory that your market, your dealership, and your inventory software says is in your sweet spot. While some may view the above as bearish and off-putting, you can see a market share opportunity if viewed through a wide-angle lens. You will see wholesale vs. retail values in Cox Automotive’s spread by average model year 2019 graph just below. It shows a widening profit gap (orange line over the blue line). We are in a favorable environment of growing profitability again, but it takes buying the right cars at the right time for your mix and data set. You can see that with the value of Luxury vs. Non-Luxury on the right in circles. Luxury has an average higher acquisition cost than the average retail asking price but is beginning to show a favorable spread. (Red circles).

The numbers are important as always, and you see below that not much changed from previous weeks on the wholesale or retail side. Wholesale value depreciation was 0.6% this week, while lane efficiency increased some. Used retail sales running close to previous years. Higher inventory levels keep days’ supply higher, though it has dropped to 47 days. New car acquisitions slowly growing.

The 3-year-old index depreciated 0.6% to 89.1%. Non-luxury declined 0.6%, while luxury declined 0.7% Values moving down 0.4% - 0.8%

Sale prices lower than MMR (-2.11%)

Retail values flat for both non-luxury and luxury

Lane efficiency increased for 3-year-old and 6-year-old models

Used retail sales still running close to previous years. At 47 days, days’ supply was higher than in previous years due to higher inventory levels

New car sales ran 30% - 35% below in 2019 and 2020. Days’ supply at 35 days and inventory increasing slightly as acquisitions increase

Cars will continue to sell, and buyers will continue to buy. You can read more about how to take advantage of the current market conditions by thinking differently HERE.

Surgical execution is vital, and data into insights is the scalpel.

Happy Selling

John Ellis, The BEV Guy