As the federal government enacts the new inflation recovery act, the prospects of inflation getting under control seem to be a big question mark. The big concern for consumers in the market for a vehicle is the price and the interest rate. There's no question this time is challenging, and we see some headwinds on the horizon. However, our current situation reminds me of a position I took on used car valuations in an even tougher economic climate at the height of the pandemic. I was honored to have Dale Pollak mention my article in his blog and admit it made him rethink his stance on the matter. His blog was titled “A Brighter View.” I still have that brighter view today. Read on, and I will explain how it was revealed and how it applies again to automotive sales today. Click to view Dale’s blog.

Back in October of 2021, I wrote an article speaking specifically to the fact that even though the value of used vehicles was increasing by the day, the purchase of a used vehicle made the buyer and the seller a winner. It wasn't one-sided, as most of the industry seemed to think and write about.

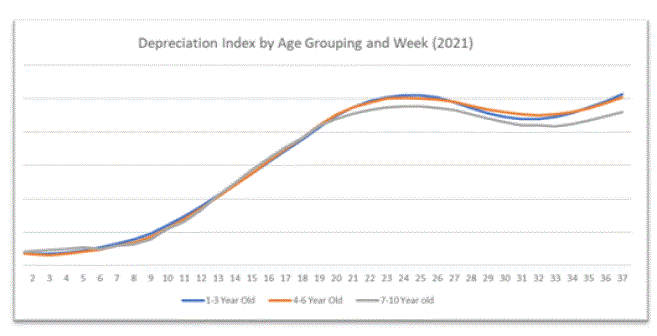

As an economist, I went back to the data and the trends to determine if my thinking was accurate. I found that the value of used cars was growing exponentially, making them more expensive, and consumers had to pay more for a car that cost less just a year ago and even a few months ago. You can see that in the inverted depreciation chart just below. That sounds very unfair until you think about it and look at the market as a whole. However, that also made shoppers’ used car trade-ins skyrocket, shown in the same appreciating curve below. So when you looked at the whole deal, the consumer won mathematically.

Here’s how. The car's retail price was growing at around 40% and roughly 3% less than the value of the trade-in they were bringing into the dealership. Car buyers netted out a +3% equity gain regardless of the cost of the vehicle. As the chart shows just below, it was a better time to buy a car in 2021 than in 2016,17,18 and 2019 if you had a decent trade. Most dealers I consulted didn’t have that view to change their thinking, and this chart was an eye opener. Many industry headlines shouted that the car was too expensive and no one would buy it. So how could dealers help their customers see this advantage if they didn’t know and all the noise told them otherwise? That is where consultants and partners with data and insights can add exponential value.

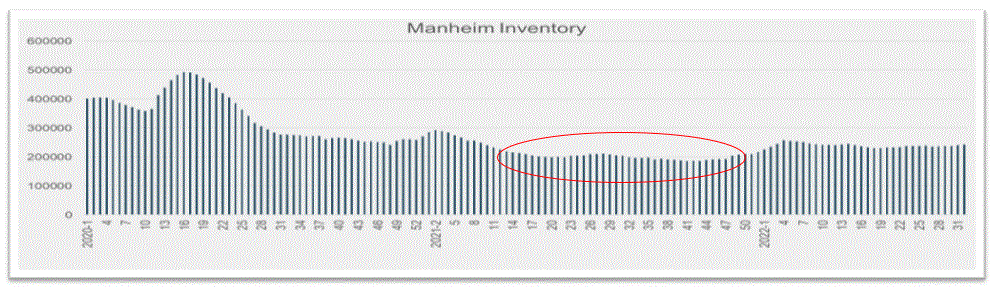

You might ask why the vehicle’s trade-in value grew faster than the retail cost. The reason is simple and complex because it has never happened this way before. Dealers needed trades more than retail sales because the auctions were being cannibalized by the commercial players, rental and fleet companies for the first time I can recall. That had the exponential impact of driving up the acquisition price of cars in the auction lanes. A trade was a much better way to get the inventory they needed, so they paid more for it. A lot more. That’s why the value of a buyer’s trade grew faster than the cost of the new car they were purchasing. You can see the inventory shortage displayed in the red circle below.

Using these insights and a new understanding of the market, dealers began to train their sales teams to consult, not sell. To educate their customers and help them see the deal's value today and the risk of waiting to take the deal tomorrow with visuals. I even suggested Dealers print out the graph above and put it in their morning sales meeting room for a daily refresher.

So how does that apply today? The market is different. That is true. However, if we learned how to think differently back then, we can take that same paradigm-shifting approach to today's market and sell more cars. Used vehicle values are declining at auction, retail prices for used vehicles are softening slightly, and interest rates are rising quarter after quarter. People are nervous and sometimes reluctant to buy when they think the interest rate has risen and the deal is no longer favorable. However, looking at the chart below, it's easy to see that interest rates are historically low. The market is still favorable. It’s also important to understand that the feds are continuing to try and get inflation under control and have signaled that they may raise the interest rates again this year. So you can use the same consultative approach with prospective buyers and show them the data. Show them that interest rates are historically low, but if they wait too long to decide, the interest rate might be higher when they choose to complete the purchase. Use the Fed’s own words. In simple terms, show them the best deal on a vehicle is the deal on the table today.

I understand this mathematical and economical approach can sometimes be boring and not very colorful. However, the mindset shift can serve you for a lifetime if you learn to think differently. Understanding the data under different market conditions will help you find a positive outlook to improve your sales. The goal is to get your people excited by understanding the value they are delivering to their prospective buyers. That gets the buyers excited by understanding the value they're receiving. That’s how you create raving fans and take market share over others who only look at the headlines and act accordingly.

This analytical and consultative approach has allowed me to help clients grow substantially in down markets for many years, but most importantly, during the pandemic. I've been fortunate to be an economist in sales for 35 years, with 20 of those years in automotive. With that unique perspective on the market, dealer operations, and economic indicators, I could find and use actionable insights to help dealers create executable growth plans.

The intent of this article is to convince you that you can win and take market share in any market. The key is finding a good consultant partner to bring that relevant data to create actionable insights and aid you in your strategy development. When you do, you WILL win in any market.

Happy Selling

John Ellis CBC / The EV Guy