Can we trust what we are seeing?

How old school thinking alone won't be enough to face what's coming.

It's been an exciting week with mixed news in the automotive industry. In this week’s blog, we will discuss what we are seeing first, and then I will give thoughts on strategy and outcomes for the remainder of this year into next year. If you are an operator please stay with me until the end. I make some unusual perdiction with evidence that I hope will get you to think differently and win in the coming months. Let’s dive in to try and bring clarity.

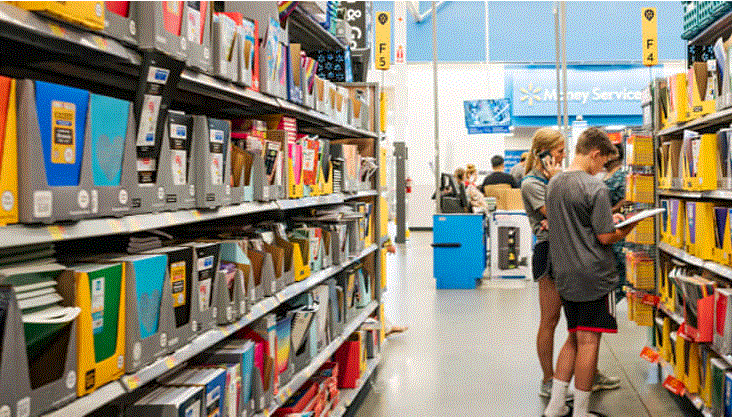

The used car day supply is rising, and that has many concernd. Thinking old school may get you in trouble here. Consider the following.

1. We've heard in the last few weeks that factories have shut down, even if intermittently, due to the heat wave in Asia, hurting the new car supply chain even more. You can read more about that HERE.

2. In a Bloomberg interview, Cox Automotive's Jonathan Smoke mentioned that a recession with this type of supply environment would be milder than we expected. You can hear more about that interview HERE.

3. Automotive news reported this morning that US auto loan providers are making it easier and faster for dealers to get auto loans. I wouldn’t expect them to do that if they saw a downward trend in the economy. You can read more about that HERE.

4. CNBC is reporting just this week that economic indicators are signaling spending power is growing and should continue into next year. That will increase consumer confidence and bolster the economy when it needs it the most. Wage decline is one of the primary indicators of inflation. Also, if this prediction is accurate, it will help slow the default rate down and keep the repossession rate at its all-time low. That’s the hope, anyway. You can read more of that HERE.

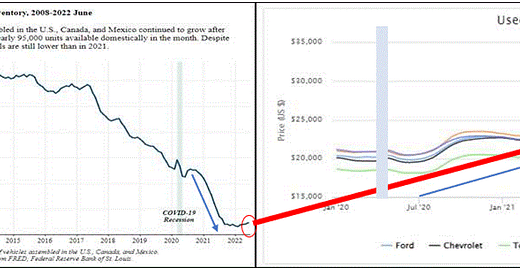

The two graphs below show a direct correlation between the new car supply on the left and used car prices on the right. The new supply will be working hard to get back to baseline but will most likely take ~18 months to 24 months. This is the underlying foundation for the lighter recession Jonathan mentioned, along with my prediction of a soon stabilization of used vehicle values in the wholesale channel coupled with the continued stable retail price. Based on information from CNBC, they project purchasing power could grow the remainder of this year and next, and that would result in an increase in demand from sideline intenders that will increase vehicle values in the wholesale channel as well.

In the next set of graphs below, you can see the decline in new vehicle sales YOY in the second quarter by segment on the left and then the growth of new EV sales in the same quarter to the right. I predict manufacturers will help fill the new vehicle deficiency created in the last three years with EV sales. I expect they will intentionally divert some ICE resources to that cause now that the Inflation Recovery Act has been signed and incentivizes them to focus more on EV production. Time will tell that story.

The numbers themselves only tell half the story but are important. Here they are:

Accelerating slightly, the 3-year-old index depreciated 0.7% to 89.7%. Non-luxury declined 0.6% while luxury declined 0.5%

Auction sales prices lower than MMR (-1.98%) - MMR Retention

Lane efficiency is down for 3-year-old models and up for 6-year-old models

Used retail sales are still running close to previous years at a 48-day supply.

Retail values stayed relatively flat for both non-luxury and luxury.

The question we have to ask ourselves is this. Knowing the numbers above and understanding how the market has performed in the past, what can we expect to see wholesale values do for the remainder of the year? To answer that, you have to use a wide-angle lens. Retail values are staying somewhat steady and holding price strength. That doesn't make sense considering sales are soft and inflation seems to be brewing. Adding interest rate hikes and rising delinquency rates on top of that tells us that the second half of the year could be very gloomy and, in 2023, even worse. Some are saying just that. I am not for many reasons, including the four bullet points above.

I see factors in the market that will trip us up if we think about it the way we've always thought about it. Wholesale prices are declining because dealers are driving down value in the lanes due to less purchase activity. One reason is that the day supply on dealer lots is holding steady at sales rate. With sales rate static, there is no need to overbuy as they had been. That can be seen in the graph below, where 2022 is above all three prior years in day supply.

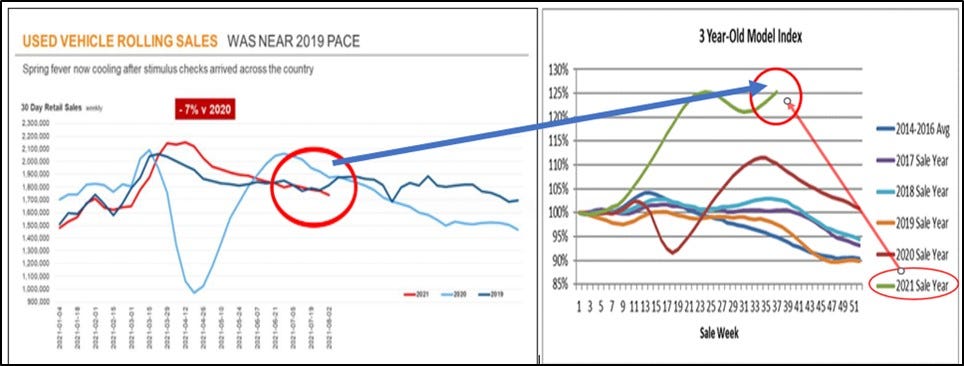

The same thing happened last year when dealers drove up the cost of acquisition in the wholesale lanes in preparation for high demand, not due to customer demand. The sales rate did not support this aggressive price valuation. You can see that in the graph just below, where sales were declining on the left in the same time period that MMR values were increasing on the right. (shown in the red circles) Follow the blue arrow for the nonsensical correlation. In my opinion, the reverse is happening now. Dealers are driving down the cost of acquisition in the wholesale lanes, not necessarily the customer. The automotive market we operate in now is very different than any we have seen in our lifetime. 2008/2009 doesn't compare for many reasons. We have to think differently to win.

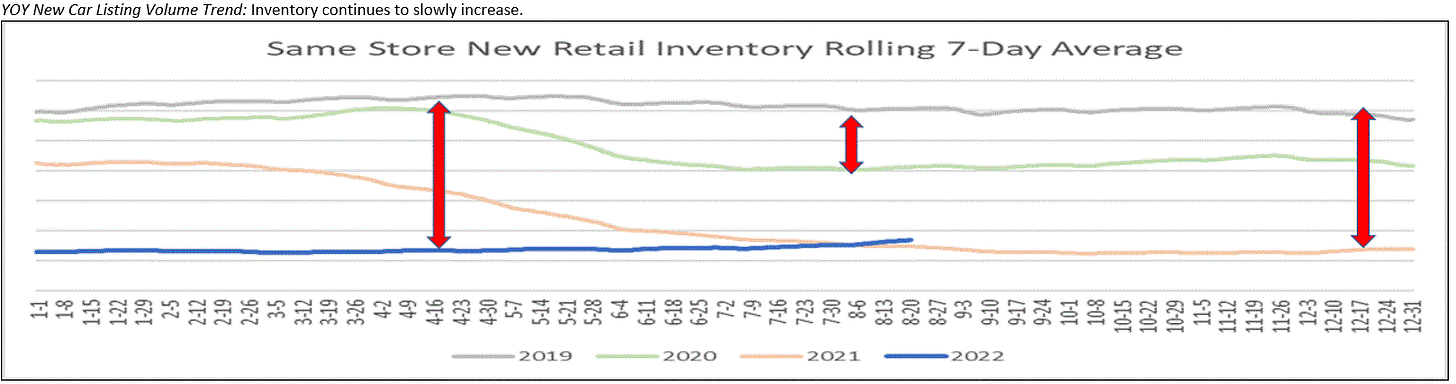

As mentioned above, there are a lot of good signs going into the second half of this year and 2023 for our economy and the consumer. The most significant sign is new car production will not reach baseline this year, so the bottom will not fall out of used car prices, leaving dealers holding the bag. As you can see just below, we have a long way to go to get close to filling that deficit to satisfy the dealer demand and the commercial fleet demand.

If the experts are correct that consumer purchasing power grows in the second half of the year and grows even more in 2023 due to wage growth and unemployment decline, we should keep a close eye on those indicators. If that plays out, we could see that pent-up demand driving demand for the freshest inventory and again start growing the cost of acquisition in the wholesale channel. I'm not 100% certain that will happen, but all the indicators say it could. My message is “let's don't miss it” by contracting with acquisitions or backing off of exposure. Let's make sure to prepare and stay ahead of it. That's why we can't think old school about the decline in wholesale values in this unique market the way we always have.

The next few years will take much more thought than simply day supply, listing volumes, lead counts, overall traffic numbers, and consumer demand indexes. The entire economic view, including international Geo political conditions, is in play for long-term investment strategy decisions, that includes the EV economic landscape.

We are here to help,

Happy Selling,

John Ellis