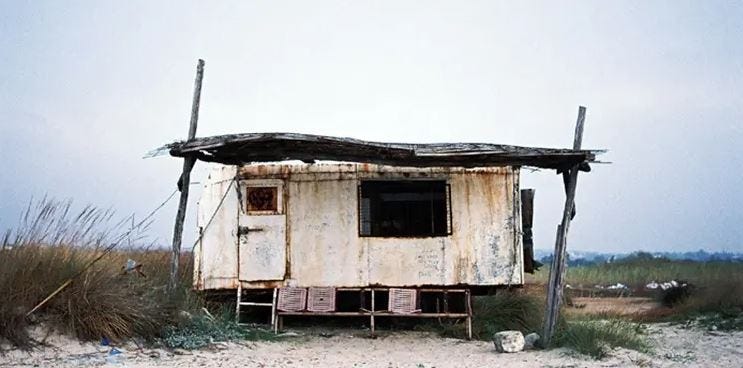

If you're a fan of Home & Garden Television, you know how many shows are around buying and selling homes. The question that's always asked prospective buyers is, do you want a move-in ready home or a fixer-upper? Do you want to pay less upfront and invest more on the back, or are you willing to pay all the money upfront? The same question can be asked while formulating a used automotive acquisition strategy today.

We are in a constrained market with a lot of uncertainty that demands us to think differently and transform. While we continue to see a steady pace in used retail sales weekly, the overall retail sales are down 23% YOY. Used supply is up 13%, yet the average used retail price is also up 27.9% to 28,000 over this last year. That price elasticity can be confusing on face value by only looking at the supply volume of used (+13%) versus the used demand strength (-23%). The story becomes more apparent when you look at the quality of that supply, not just the quantity. If you're only looking at the supply of inventory in the market and the number of leads coming in on that inventory, you can get fooled rather quickly. The story goes a lot deeper.

As we have mentioned over the last year, the supply of used inventory is aging exponentially with higher miles and more repairs, making retail-ready inventory harder and harder to acquire. If that retail inventory is available, dealers are fighting each other and commercial players for it. That is unlike anything we've ever seen before. So the impact on the acquisition price is driven not merely by consumer retail demand but also by dealers' demand for fresh inventory they can sell and commercial parties' absolute need for it to sustain their business model.

For those of us that hoped this spring bounce would be stronger than it was, here is some brighter news from Cox Automotive's Chief Economist, Jonathan Smoke, this week, "We anticipate the second quarter – and particularly April – will be the strongest part of the year for used-vehicle sales and values."

Nothing could be done about the lag in the IRS sending refunds out to consumers promptly in Q1. That delay, unfortunately, gave inflation and the unrest with our neighbors in the west time to sink in. Now that the refunds are in the mailboxes, consumer confidence is at an all-time low, and that is showing in all areas of the economy. The good news is that used cars will continue to be sold, and building a strategy that matches the current and future conditions matters.

Many dealers are grappling with the “Move-in Ready or Fixer Upper” approach to inventory acquisition. Do they fight with commercial and overpay for retail-ready inventory in a slow but steady retail market. Or do they buy a little deeper and spend a little more on reconditioning to approach the market differently. I say both is most likely the best answer. The best approach is to work with your industry partners to gather the data and insights needed to plan, execute, and win in any economic condition.