Automotive Market Update 11/ 24 /2022

Happy Turkey Day!!! We are Thankful for you, our subscribers.

Happy Thanksgiving. We are thankful for you!!! So this week’s update is a day early and complimentary if you aren’t a paid subscriber yet.

Please don't let FREE fool you. This week’s report is full of actionable insights from leaders like David Long and Durran Cage for the upcoming selling weekend starting Friday. We even have Dale Pollak’s interview with ASOTU last week. We are sure it will prove invaluable.

Starting NEW this week, Durran Cage and David Long will have regular mic-dropping best practices in a BDC section and a Vehicle Acquisition section. Don’t miss those or the EV section each week.

We hope you have a blessed Thanksgiving with friends and family.

Current Economic Outlook:

The impending global recession will see sluggish growth or outright contractions in GDP in most major economies with the1990s being the most comparable to the current situation. However, Capital Economics research firm is forecasting a relatively swift global recovery. You can read more about that here: Global Economics Drop-In

The global economy is heading for a recession as tightening bites. You can join this 20-minute online briefing to find out which economies will be hit hardest, the outlook for inflation and central bank actions, and the risks ahead. Register here.

New Car Market’s Current State:

The big news this week is Toyota cutting its production forecast by 750,000 globally. Supply, specifically chip shortages, are the catalysts for this adjustment in production forecasts but what it tells us is the new vehicle market is not set up for a comeback just yet. You can read more about that HERE.

The new car day supply is down three days and the sales rate was up 12,000 from last week. Demand is still strong shown by the price being up $264 from prior weeks. As mentioned and shown in the graph below, the only softening trend in new cars is the day supply. It looks like the sales pace is catching up with allocation. As a result, you can see in the first graph below that the available supply of inventory for new cars in the market is starting a downward trend. This is something we'll have to keep an eye on over the next few weeks.

Used Car Market’s Current State:

The day supply of used inventory is down from last week but 26% above last year. We keep hearing about available inventory in the market and how that impacts demand and prices as well as valuations in the acquisition market. However, with the aging of the day supply, and the average age expected to be 16 years for used vehicles in operation (VIO) in 2023, we have a long way to go before day supply becomes the same indicator it once was.

Used car sales remain relatively strong so the question is how long will used valuations and used car prices continue to drop before we start preparing for the upcoming tax season and spring bounce. I give thoughts on this in the summary section below. It is certainly something we'll have to keep an eye on weekly.

Wholesale Market’s Current State:

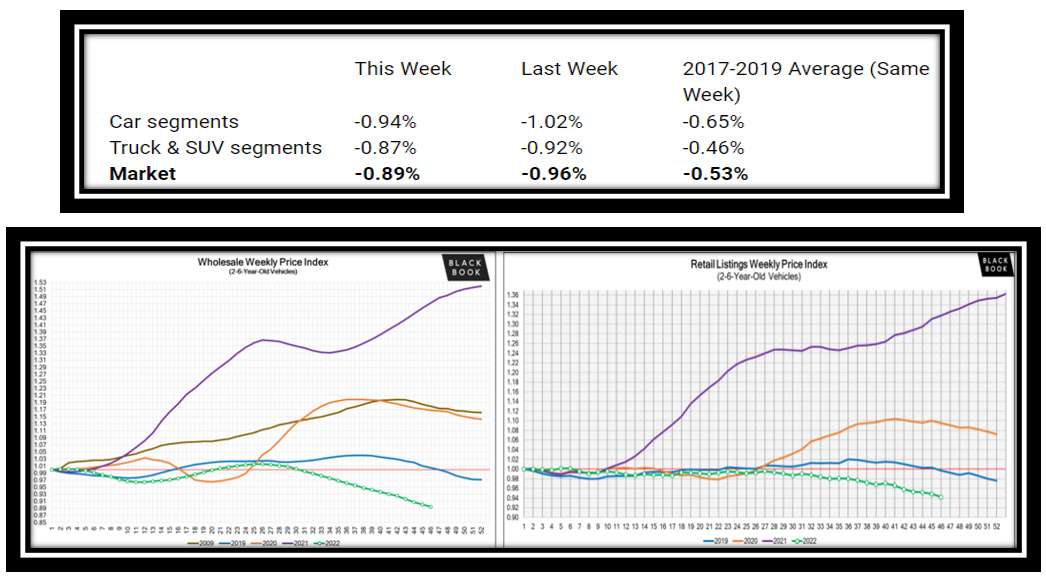

The wholesale market is still showing a much deeper decline in the car segment than in the truck and SUV segment. As we discussed last week the car segment has more demand in the retail market today than the truck and SUV segment. Most likely due to gas prices.

That dynamic seems to be a white space opportunity for dealers but the gap is starting to close. With the weekly wholesale price index of two to six-year-old vehicles from Black Book below hovering around the 90% level and the retail listings price valuation around the 95% level, it's clear that there is softening on both sides of the market. We'll evaluate what that looks like in the “Retail Risk and Opportunity” section as far as profitability and the impact on the water levels of aging inventory.

Vehicle Acquisition Strategy Idea of the Week from David Long

Almost every dealer has some form of a direct-from-consumer vehicle acquisition program. As an industry leader in this area, David Long has some advice on what he has seen work very well firsthand.

“The Buy Centers that succeed at the highest levels are the ones that stay with the customer long enough to gain the trust needed to earn the purchase. We call this the Rule of Eight. This rule is built around a private party seller being contacted a minimum of 8 times during the process. It has proven to be incredibly successful.’

You can reach out to David Long for more information on his Buy Center Program HERE.

Best Practice Idea of the Week by Durran Cage of Cage Automotive:

Your BDC can no longer focus on just “driving appointments.” Your People must expand their focus on driving experience first. Experience is best delivered through video, pictures, and words collectively.

You can reach out to Durran HERE for more detail and best practices to start 2023 off with a bang!

Retail Risk and Opportunity:

The market is not as aggressive as it was a few weeks back, but it is starting to turn in on itself and something we need to watch week after week. With new car supply news like we saw this week from Toyota, the values of used cars should start stabilizing and possibly increase. It'll start in the wholesale channel first and then move to the retail channel. If that happens, we can expect to see more margin erosion until the retail selling price catches up. As we have seen over and over, that usually takes four to six weeks. This is not a certain prediction but something we need to watch as we start approaching tax season. There will be key indicators all along the way.

Here is this week’s PVR by the numbers. Last week the gap between wholesale and retail was $2809 and this week it's $2845. That's a $36 increase over last week but narrowing. For non-luxury, the PVR gap was $3398 compared to $3335 last week which is a $63 increase but also narrowing from last week. And finally, the luxury PVR gap last week was $2180 compared to $2260. This gap of $80 is an increase of 30% from last week.

Taking into account that retail days-to-turn is going back up week after week, seen above, the guidance is to be very careful of the market’s impact on aged inventory. It's good counsel to follow the advice of industry-leading experts like Dale Pollak. Dale reminds us that margins are eroding and we can't be stubborn about that. Keeping a 30-day inventory mindset, based on your fourteen and thirty day rolling sales average, is a good play to reduce risk and keep all dealership departments humming.

You can listens to Dale Pollak’s own words below.

<iframe style="border-radius:12px" src="width="100%" height="352" frameBorder="0" allowfullscreen="" allow="autoplay; clipboard-write; encrypted-media; fullscreen; picture-in-picture" loading="lazy"></iframe>F&I Market Current Outlook:

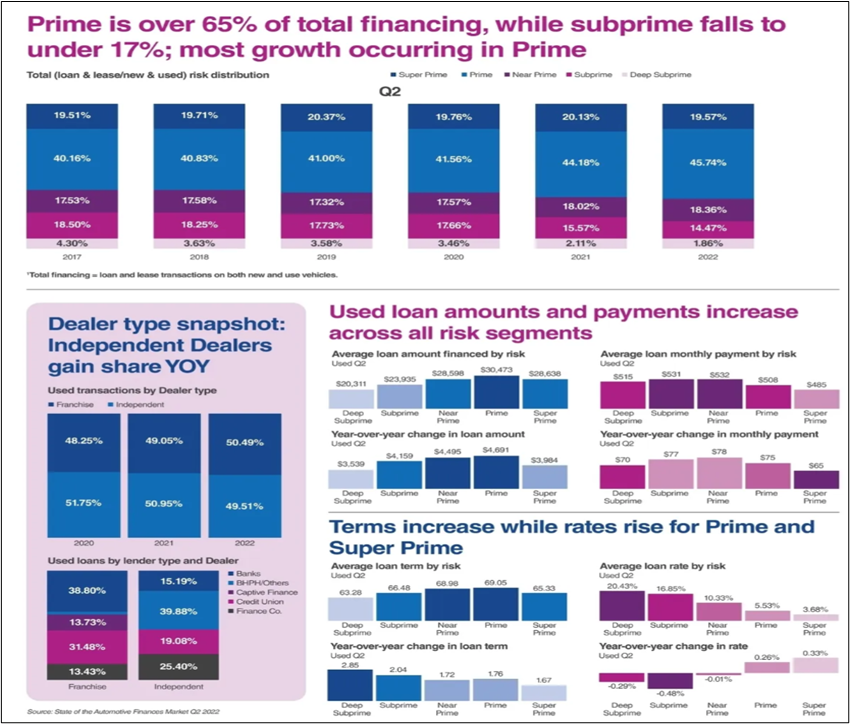

The credit markets are still showing signs of strength with prime being over 65% and subprime still falling. No doubt much of that has to do with the savings accounts left over from the pandemic but also creditworthiness which gives the ability to stay current on obligations.

The significant news here is that payments and total loan amounts are continuing to increase across the board impacting affordability. Take a look at the details below and see if you get an idea of how to work these trends into your customer conversations. Reach out for ideas.

Summary:

By now most of the meat has been picked off the bone. Notice the Thanksgiving Turkey reference.

However, my parting thoughts are this. We will do well to pay attention to the forecasts by the OEMs impacting new car supply moving into 2023. We want to watch how that impacts consumer and dealer perception alike. That will impact reality as we move into tax season. I expect used vehicle acquisition prices in the wholesale channels to start rising as we get closer to tax season and the spring bounce. That acquisition value usually happens four to six weeks before the retail starts rising to follow. That means there's more margin erosion in the short term.

Dale Pollak's advice to David Long and ASOTU this week is more important than ever. We have to get over wanting the same profits we've had the last three years and get back to reasonable expectations. Those days are gone, at least for the time being. Reach out if you want to discuss this in more detail HERE.

Latest EV News: “ EVs are coming!!”

For the latest EV news, videos, training courses, and retail consulting click HERE. As you can see below, consumers are considering EVs in large numbers and it is growing by the quarter. We're building this EV community to help dealers prepare for that coming tsunami.

Many dealers today are moving towards EVs in a very passive way. Two things are wrong with that approach, One, dealers will need as much runway as possible to get their dealership's processes and people ready. It takes more than just a few months to reach best-in-class status. Two, OEMs are looking for guidance and partnership in all areas. Dealers that are ready and able to assist will most likely help shape the EV future.

Join the EV community HERE and have all your dealership personnel join too. As it grows your dealership teams will also grow in knowledge and confidence and be ready for EVs.

Thank you Stacy

This was so well put together! Great content, thank you so much!