If you got ‘em…...price to sell ‘em!

You make money when you buy a vehicle not when you sell it and is important that your buy plan is based on profit goals in the current market. That knowledge has proven to be the biggest single factor in inventory turn discipline.

The Automotive Advisor Team’s Used Car Optimizer Program (Above) builds fundamental Used Car buy/turn/profit plans with continual trackability throughout the month and adjustment levers to ensure you stay on the right plan to meet your sales goals each month. Dealers are raving about its impact and the success month after month is real. Reach out to the team for a demo: info@theautomotiveadvisorteam.com

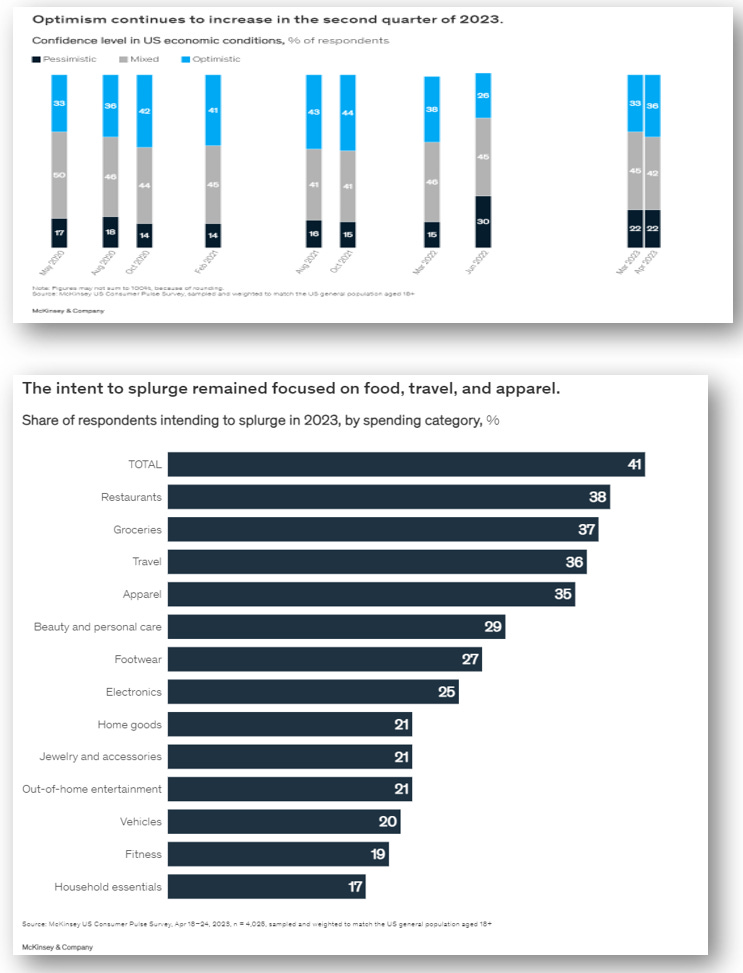

Economic Outlook SOURCE

What’s the latest: 36 percent of US consumers expect a quick economic rebound. Optimism isn’t yet back to 2021 levels, but it’s trending in a favorable direction.

Why it Matters: Consumers in the younger demographic groups and the higher income brackets continue to be the most optimistic about their economic future. A pattern that has held throughout the pandemic and after.

Bottom Line: Consumer optimism is on the rebound and the propensity to overspend in certain categories is still showing signs of strength heading into Q3. Going after the younger demographics may prove to be an area of opportunity for dealers' marketing campaigns and vehicle acquisition efforts. Reach out to The AA Team for an analysis of that and your market specifics.

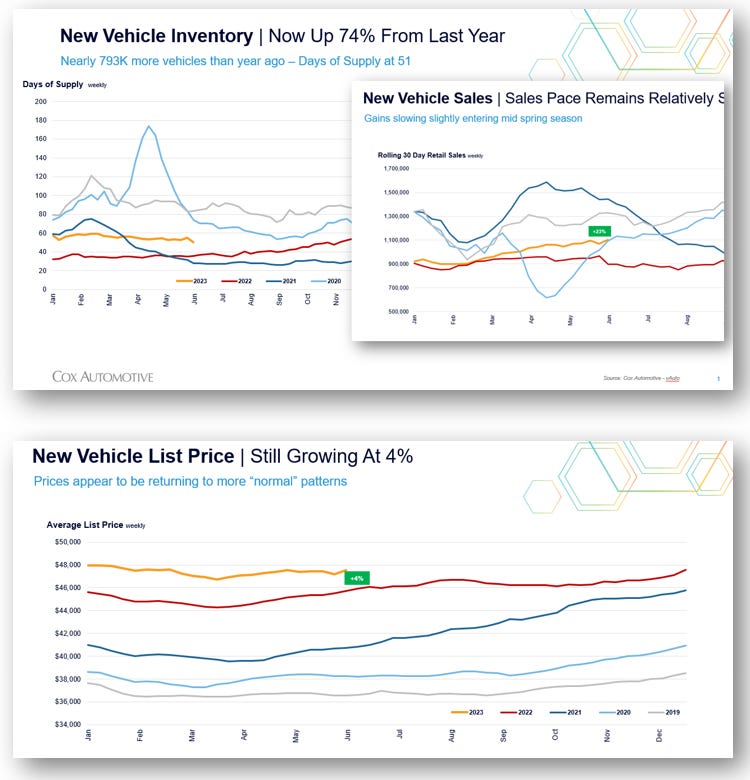

New Car Outlook

What’s the latest: Days of supply is 51, down 4 from last week but stable. DS is now 42% above last year.

Why it Matters: Sold in the last 30 Days is 1.10 million, up 33K from last week pushing supply down. The sales pace is now running 23% above last year with the Average Listing Price being $47,521, up $354 from last week.

Bottom Line. Prices are up 4% over last year and holding at near this growth level since February but the pace has slowed slightly over recent weeks which is good news for affordability and monthly payment shoppers.

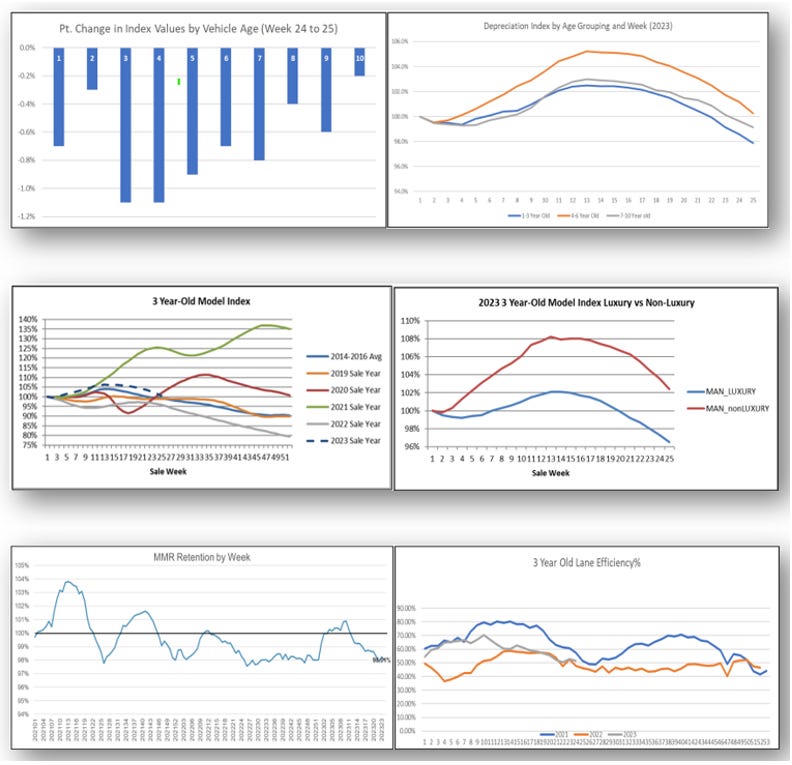

Wholesale Outlook:

What’s the latest: The 3-year-old index depreciated at a higher rate this week down 1.1%.

Why it Matters: Lane efficiency was relatively flat and sale prices were 2% below MMR (MMR retention). Retail used sales trended close to 2019 levels.

Bottom Line: Accelerating, the 3-year-old index depreciated down to 100.6% from a high of 106.4%. Non-luxury decreased by 1.2% and luxury decreased by 0.8%. All model years depreciated week over week, with 3- and 4-year-olds declining the most. It continues to be a buyer's market with deals to be had in the wholesale channel. The caution is the rapid value depreciation of aged inventory on the lot in this market. Agin….If you got ‘em…..price to sell ‘em!

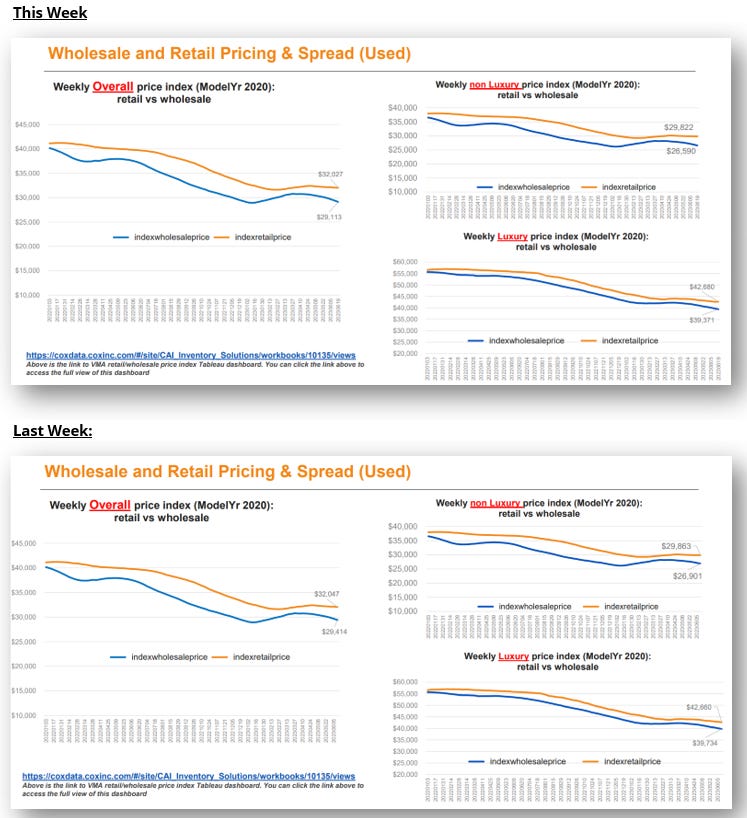

Retail Margin Outlook

What’s the latest: The average model year 2020’s retail price dropped $20 and its corresponding wholesale price dropped $301.

Why it Matters: Once again the wholesale market is giving us $281 in gross margin

Bottom Line: It isn't always the case, but the auction is an area of opportunity for dealers needing inventory to meet sales goals. However, these margins do not include buy fees and transport fees along with the heavy reconditioning fees that often come with auction cars.

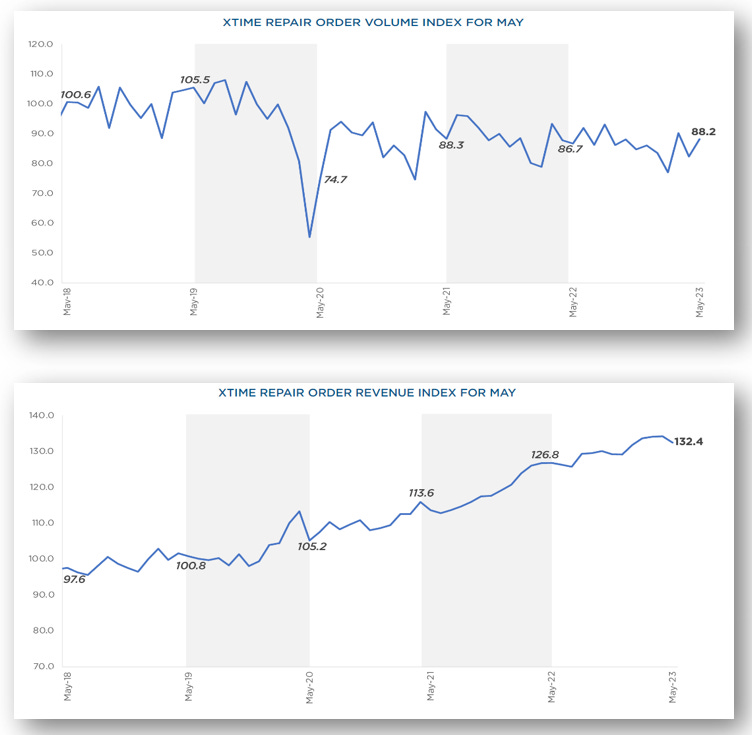

Service Outlook: Source

What’s the latest: The May Repair Order Volume Index increased to 88.2, up 7.0% month over month from April’s upwardly revised number and was up 1.8% compared to May 2022, marking the first year-over-year increase in service ticket volume since January.

Why it Matters: At 132.4, May’s Repair Order Revenue Index was down 1.3% from April’s upwardly revised reading and is up 4.5% year over year. The average revenue generated per repair order decreased by $8 off the revised record high in April.

Bottom Line: With repair order volume up and repair order dollars down, there's a unique opportunity in the service line to acquire vehicles through cooperative strategies between the Used Director and the Service Director. Find the ebb and flow in your dealership and this can be a lucrative acquisition channel for you. If you need help in this area reach out to The AA Team for ideas and strategies that have worked with our clients.

F&I Outlook: Source

What’s the latest: The average auto loan rate declined by 4 basis points (BPs) in May compared to April, while the 5-year U.S. Treasury increased by 6 BPs, resulting in a narrower average observed yield spread.

Why it Matters: The share of loans with greater than 72-month terms increased 0.6 percentage points but was down 0.2 percentage points year over year.

Bottom Line: Credit availability also declined in May across most lender types. Auto-focused finance companies loosened while all other lender types tightened, and credit unions tightened the most. On a year-over-year basis, credit access was tighter across all lender types, with auto-focused finance companies tightening the least while credit unions tightening the most.

Summary: We will say it one more time…If you got ‘em…price to sell!

In a market like this following variable used car management and understanding the difference between high-demand and low-demand inventory will help develop secure pricing strategies and minimize risk. Weapons like Stockwave and its associated Business Plan can help you build the most attractive inventory alert systems in your dealership to never miss a Year, Make, Model, or Trim you need.

Surgical execution of a buy-play strategy focused on acquisition channel efficiencies and profitability is the way to drive forward and grow in this market. New car affordability is making it difficult for new cars to save the day and use car operations will have to pick up the slack. Total departmental profit should be the goal and demanding each vehicle hang around until it makes an average front-end minimum will cause significant losses.

Reach out to The Automotive Advisor Team to discuss their Used Car Optimizer Program that builds fundamental plans of execution with trackability and adjustment levers to stay on goal each week and each month of the year.