Economy Source

Consumer spending decelerated in May and was weaker than expected. April’s nominal spending was revised to a smaller 0.6% gain from its original 0.8% estimate. But, Personal income growth accelerated to a 0.4% gain and the personal savings rate increased to 4.6%, which tied March for the highest level this year and the highest since January 2022. In summary, consumers have money but are paying off debt and building back savings as a primary goal. Spending on housing and vehicles is more of a need than a want in the aggregate so a lead or a shopper is more valuable now than ever before.

New Car Outlook

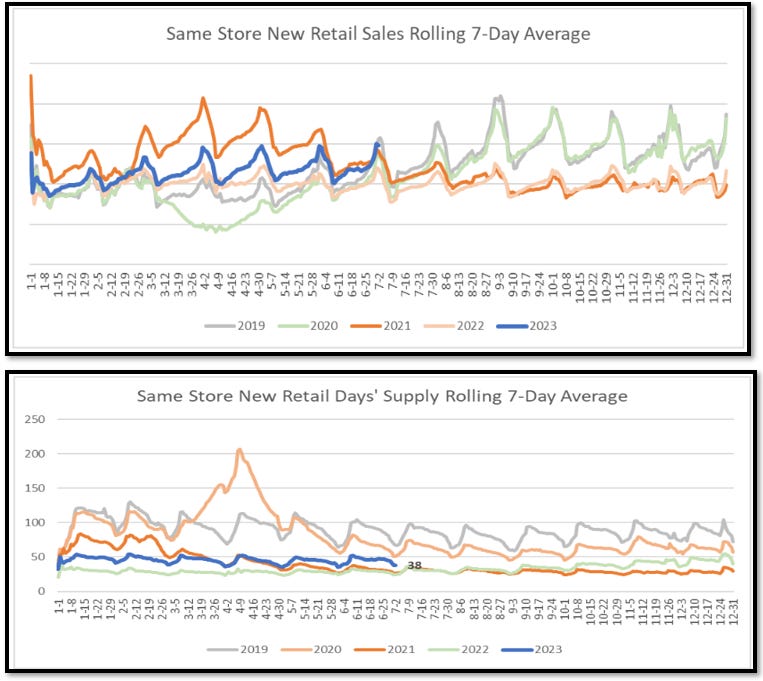

New car sales are as running close to 2019 as seen below but below that you can see, despite the news about new car supply, we are still running well below 2019 and 2020 levels and that is hurting used car trades.

Used Car Outlook:

The sales rate is still trending close to 2019. Although it has increased, inventory is lower than most other years with day-supply within the normal range at 40. Days’ supply dropped at the end of June for all three segments and the acquisition rate is still running higher than the sold rate. The bottom graph shows dealers are buying 110% of what they are selling and lots are getting full. Our Buy-Plan budgeting software prevents that from happening in real-time. Reach out to the team for a demo.

Wholesale Outlook:

The 3-year-old index depreciated 1.0% to 98.7%. Both non-luxury and luxury decreased by 0.9%. All model years depreciated week over week. Sale prices continue to run further below MMR (-2.47%). Lane efficiency dropped for both 3- and 6-year-old models but ran ahead of 2023.

Retail Spread: Wholesale to Retail Value Summary:

2020 model year non-luxury wholesale values decreased by 0.9%; retail values decreased by 0.5%.

2020 model year luxury wholesale values decreased by 0.9% and retail values decreased by 0.6%.

Although retail values dropped at a higher rate last week, spreads continue to improve as wholesale values have dropped more sharply than retail values.

Summary:

The market is slow and steady and the retail price is starting to reflect that. However, so is the acquisition market, and that value is declining almost 50% faster than the retail market. This spells good news for dealers and shoppers with used vehicles not increasing but decreasing eventually making them affordable to more buyers.

The economic conditions are not stellar but the bright spots mentioned above, higher wages and consumers saving more, means the future is bright. The key right now is every lead, every online shopper, and every up is gold. If they are attempting to buy, they are more serious than in the past. Don’t let them slip away to another dealer. The law of averages is not on our side in this market.

Happy Selling

John Ellis

john@theautomotiveadvisorteam.com