Economy Source

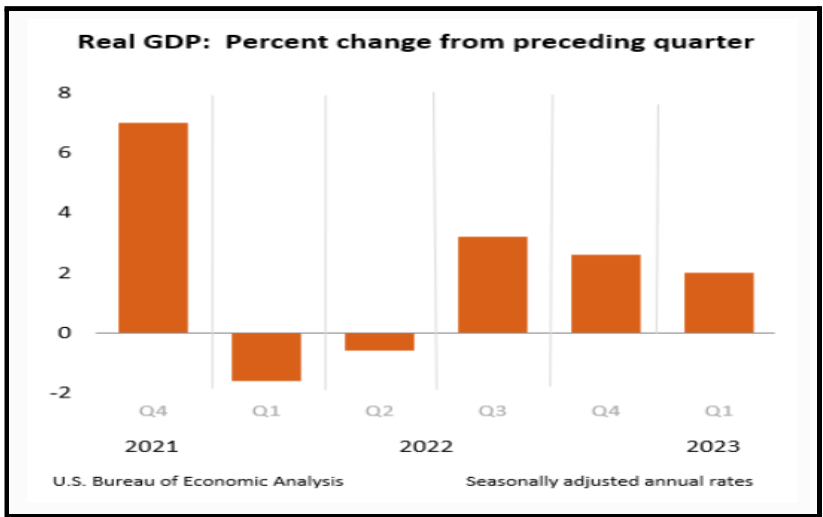

The economy grew 5.9% in 2021 and slowed to 2.1% growth in 2022 with declines in real GDP in the first two quarters followed by 3.2% and 2.6% annualized growth in the final two quarters. Growth slowed to 2.0% in Q1 2023. Consumer consumption had been slowing but accelerated in the first quarter, which caused inventories to decline while residential investment also fell. The economy was more substantial than expected in Q1, but growth did slow modestly as the quarter progressed.

The consumer sentiment index from Morning Consult increased by 0.1% w/w today. It declined 1.8% in May, increased 4.4% in June, and is up 0.1% so far in July. Consumer views of the future have been the highest since August 2021. As of today, sentiment is up 20.5% y/y. The average price of unleaded gasoline declined 0.2% w/w as of Thursday to $3.54 per gallon, which was down 26% y/y.

New Car Outlook

The average transaction price of a new vehicle in June was up 0.3% from May at an initial estimate of $48,808 and the average price gained a little ground but remained below the average MSRP. The average price was up 1.6% y/y while the average MSRP increased 0.3% in June from May and was up 3.8% y/y. The average incentive spend from manufacturers increased 5.2% to $2,048, which was up 85% y/y. Incentives as a percentage of average transaction price increased to 4.2%, which was the highest level since October 2021. The average price relative to the invoice was steady at 11.7%, down 3.0 percentage points y/y. Pricing power has declined but remains strong relative to pre-pandemic comparisons.