This week is FREE ACCESS for all. The high-level guidance below is Too Important and should be shared with all in the auto community. Pick your operating section and read the insights there. We only ask that you comment or reply with your thoughts on this Operating Guidance Report to help us make it better. All the insight here is certainly macro-level analysis so we recommend using your industry partners and internal expertise along with this report to help formulate a strategy for success.

New this week:

In mid Q3 going against the grain, The Automotive Advisor Team predicted used car prices would start to rise and have done just that with the average 2020MY. Up again week over week, it is mostly driven by dealer demand but also by a shrinking supply. The big question is will consumer demand follow? Let’s explore that now starting with how shoppers are feeling in the next section.

Current Economic Outlook:

What’s The Latest: According to UofM, consumer sentiment remained low from a historical perspective but continued lifting for the second consecutive month, rising 8% above December and only 4% below a year ago.

Why It Matters: The reason is personal finances have surged 16% to their highest eight months due to higher incomes and easing inflation. Although the economic outlook fell modestly from December, the long-run outlook rose 7% to its highest level in nine months and is now only 17% below its historical average.

Bottom Line: Consumers are working, and wages are up. Inflation is easing some and their confidence level in the future is high. That bodes well for retail sales in any industry but especially transportation. Educate your staff on these facts so they can speak with positive energy in the sales cycle with their buyers. If all they hear is the news cycle, they of course will be pessimistic. Don’t let that happen.

New Car Market’s Current State:

What’s The Latest: New car day supply continues to trend down and is now - 2 days from last week with a total available supply of -42K down from last week.

Why It Matters: Even with the day supply being down, the total supply is now nearly 800K units higher than one year ago, or up 83% above last year. Show in the red circles and correlating red lines below, the supply is slightly down while sales are slightly up and the price is moving up as well.

Bottom Line: New car demand is still strong despite affordability. Sales were up 12K from last week and have been since September of last year. That continues to prove opportunity exists even with the average listing price now sitting at $48,003, up $412 from last week and starting 2023 up 5% over last year.

Used Car Market’s Current State:

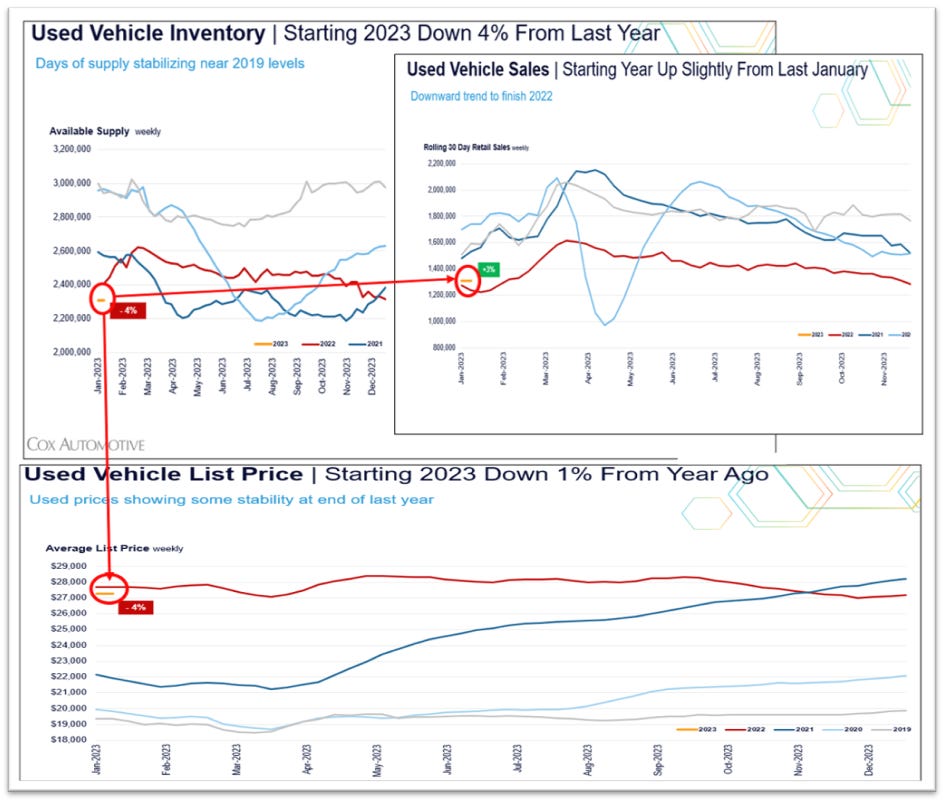

What’s The Latest: Used car day supply is down from last week but stable at 53 days and the total available supply is 2.31 million but down 8K from last week.

Why It Matters: With supply trending down used car sales are up and that's driving the price of used vehicles back up. This is something we predicted at the AA Team months back and most of the industry did not agree. As evidenced in the red circles and correlating lines below, the supply is stable while sales are slightly up, and the price is moving up as well.

Bottom Line: Use car strength is back. The average price of a used vehicle is $27,275, up $112 from last week. As we also predicted, used car wholesale prices are showing some year-end strength. We will review that next. If the past is a predictor of the future, that trend will most likely continue until sometime in late Q1 or early Q2.

Wholesale Market’s Current State:

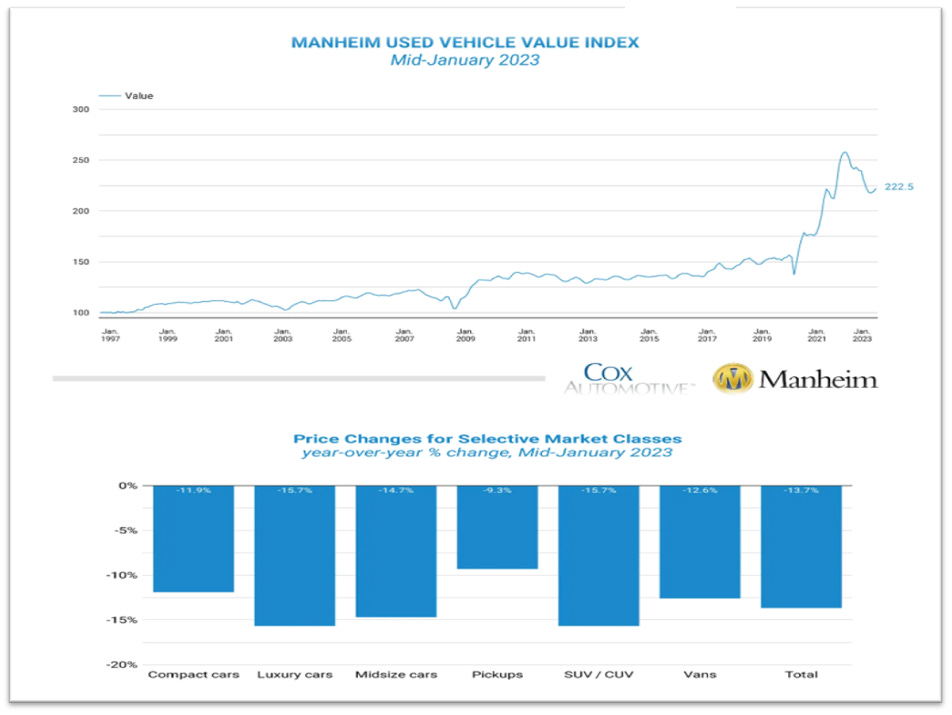

What’s The Latest: Wholesale used-vehicle prices increased 1.5% from December in the first 15 days of January. The mid-month Manheim Used Vehicle Value Index rose to 222.5, which is still down 13.7% from the full month of January 2022 but steadily risen over the last few weeks.

Why It Matters: Most of the industry felt used vehicle prices had seen their highest and were destined to start dropping dramatically in late 2022 and throughout 2023. We knew the aging day supply and tax season were the reasons that would not happen as it has proven itself year after year in both good economic times and bad economic times.

Bottom Line: The current market conditions are proving many industry experts wrong because the assumptions were not based on rich data pools for an auto and non-auto matrix analysis. We have to expect used vehicle prices will continue to rise even slightly through the first quarter of this year. Because of that, dealers need to focus on buy plans that match current sales rates and anticipated sales rates to keep from having to panic the buy and panic sell based on knee-jerk reactions. The AA Team has all the data and insights weekly to help ensure that type of strategy and execution plan. Reach out to discuss this in more detail.

Retail Risk and Opportunity:

What’s The Latest: Show below, the 2020 3-year-old used vehicle index showing a rise in wholesale prices in the blue line below.

Why It Matters: With the flattening of the retail price shown in the orange line creates a pinch in the gap between wholesale and retail which is another term for marching compression.

Bottom Line: Determining your best strategy for acquisition and sales based on this gap will help you set correct velocity or gross expectations and not get stuck with aging inventory waiting on false KPIs that the markets not giving you.

F&I Market Current Outlook:

What’s The Latest: The credit bureau said it expects roughly 28.8 million U.S. auto loans to be originated in 2023, up about 5 percent from 2022.

Why It Matters: The projected rise would be a rebound from the estimated 6 percent drop in auto loan originations in 2022 compared with 2021.

Bottom Line: Credit will be tricking for some time. Most of the growth in auto loan originations should be in the second half of this year, the Chicago data provider said, with each of the credit risk tiers posting an increase of at least 6 percent in the fourth quarter. "It's a sign of global production and global supply chains returning to some normalcy," Satyan Merchant, TransUnion's senior vice president and auto business leader, told Automotive News in mid-December.

Service Market Current Outlook:

What’s The Latest: The cars, trucks, and SUVs produced today are more reliable than ever. Many of them can go years and tens of thousands of miles before changing their oil and filters. These were the types of maintenance services that brought automobiles into auto repair shops regularly. However, with synthetic engine oils designed to last a very long time before it needs to be changed and other maintenance and repair services covered by the dealership for several years after the vehicle is purchased, these new, more reliable vehicles will change the auto repair shop’s role dramatically.

Why It Matters: Reducing the demand for replacement auto parts is another trend anticipated to hurt the auto repair industry going into 2023. With the advancements in automotive technology, vehicle owners find it increasingly difficult to repair and maintain their vehicles. As a result, shares in major auto parts stores like O’Reilly Automotive have fallen about 22%. Industry experts say the higher quality components being produced today last longer, and warrantless frequent need for automobile repairs and industry demand may continue to be soft in 2023 and beyond.

Bottom Line: The statistics on the latest automotive trends show the auto repair industry is in a good position going into 2023. Your goal is to get more of your market share.. You can read more from the source HERE.

Research shows in 2023, there will be an estimated 76 million vehicles aged 16 years or older in the United States.

The number of vehicles five years old or less is predicted to increase by almost 25%.

It’s estimated that by 2023, 18% of American households will use an auto repair service at least once a year.

Automobiles aged 12 years or older are anticipated to increase by 15%.

The average time new and used automobiles are owned in the past decade increased by 60%.

Summary

This week's auto market dealer operations report is packed full of insights to build strategies for execution given current market dynamics that weren't predicted by many and may not last long either. Always remember, the insights and guidance by the AA Team are at the macro level. Your region, market, rooftop analysis, and strategy execution should be done with your trusted industry partners.

It's important to understand that affordability and supply will remain an issue throughout 2023 but the mix and day supply of used inventory, and the fact that that inventory is decreasing and not increasing, it's a direct reflection of the car park, the scrap rate, and the lack of new vehicle production in the calendar year 2020 that's with us now.

Because of the unemployment and labor rate we've been watching the second half of this year, the AA Team has been very bullish on automotive and used vehicle prices despite rising interest rates and recessionary concerns. It looks as though we were right at least in the first quarter if not the first half of 2023. That was the period we predicted that used cars would stay strong and that margins would stay healthy. That is good news for all of us.

Latest EV News: Latest EV News: BEVEverything Team.

We had our 2nd BEVEverything Zoom “EV What and Why Wednesday” Live-Cast this week. The topics were EV retail incentives, the March deadline for finalization of the materials mandate, and some dealer workarounds using the commercial clean credit section of the act.

We had a great conversation with our good friend Larry as well. The meeting started 15 minutes after the beginning of the recording so scroll through to the 15 min mark and begin listening HERE.

As a reminder, please join the BEVEverything community HERE to learn, teach, grow and interact with other EV enthusiasts, retailers, intenders, owners, and industry leaders.

Thank you for your partnership.

Please let us know how we are doing here: info@theautomotiveadvisorteam.com

The AA Team