Are your best assets walking out the front door….

If you aren’t careful old school processes can cost you thousands a day.

Are the best opportunities we have to make money walking right out the front door? Worse yet, are we giving that opportunity and the associated profits to our competition? If our teams are interacting with customers the same way we have in years past, the answer is likely yes. This could be happening in your dealership right now. There is no question the market is forcing us to think differently. The question is, have you created a shift in your dealership to match the shift in the market?

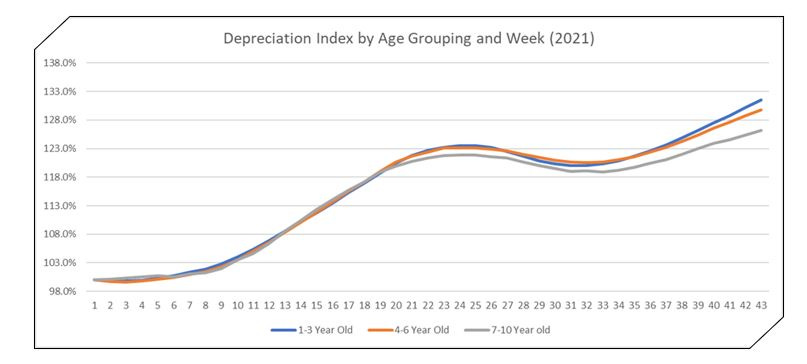

We are in unprecedented times as we all know by now. The depreciation index for used vehicles is inverted. Said another way, used vehicles are now an appreciable asset and have been for quite some time. Did you think you would ever hear that? The used vehicles sitting in your inventory are worth more today than when they were acquired and trending to be worth more next week. Now flip that. The customer’s vehicle you are appraising will be worth more tomorrow than it is today. Now let’s think like your customer. They have been told for months their vehicle is possibly worth more than when they bought it, and it very well may be. There are many reasons for that inverted depreciation curve that we’ll talk about in later articles, but in essence, this a big reason we are seeing such a dramatic shift in our industry now.

Now, back to the lost profits. I was talking with a large dealer group a few weeks back and they were still struggling with the amount of trade appraisals that weren’t being booked. We call that their “Look to Book” ratio. Their ratio is well below the industry average, and the industry average is subpar to what the current market demands. Shifting is a real struggle because the way we’ve always done it has brought so much success in the past. That makes it hard to change; however, the market and the customer are demanding that we do change.

What shift is needed? Brace yourself. We MUST start paying the customer what their trade is worth. The Actual Cash Value (ACV). The average trade-in value is trending towards $8,738, an increase of $3,598 (70.0%) from a year ago.

How do we make this shift to keep more of these valuable trades? First, we soften our first pencil at the trade desk by educating our appraisers of the used appreciation phenomena revealed in the graph below. We also educate them on the rising daily cost of acquisition in the wholesale market, including the additional front-line-ready costs if they miss the trade and must go replace that lost unit. Not to mention the potential loss of a retail deal by watching that trade walk out the door. Simply put, customers are leaving the dealership frustrated due to a poor first pencil offer at the desk, and it’s costing us in market share and in profits.

Our old school mindset tells us to treat a trade valuation like you expect your wholesale cars to be treated, of little value. That couldn’t be further from the truth now and can cost you mountains of profits. If you do the math above and then add in the opportunity costs lost in other dealer profit centers by missing the trade, it’s a must to change mindsets. The numbers demand a shift in our trade appraisal process.

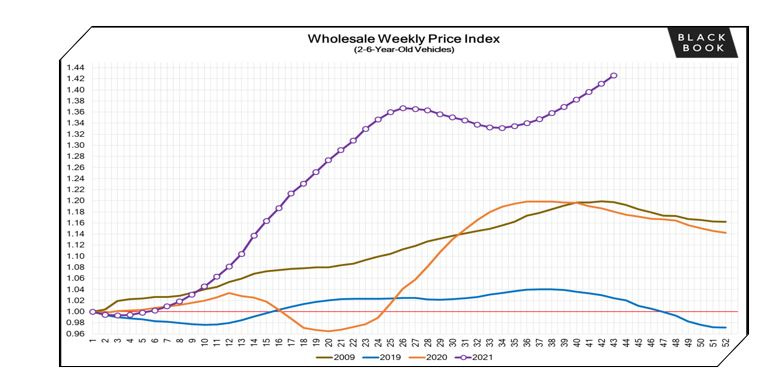

We need to work at shifting our salespeople’s mindset and challenge them to become a transparent consultant to the customer. A good first step is pinning up the full year 2021 MMR (Manheim Market Report) trend graph on the wall and reviewing it with your sales teams every morning when they walk in the dealership. Another best practice is to have one on each sales desk for the customer and the salesperson to review during the deal if needed. Talk about transparency and trust. The impact of this shift using these best practices has been more trades booked and fewer discounted retail vehicles.

The goal is to help our people have the right mindset and perspective with their customer on the other side of the sales deal when appraising and selling. It can be a win for the customer and a win for the deanship.

To be the best in this market your “Look to Book” and CSI score should be the highest it’s ever been. For that to happen this shift must happen. Get with your inventory team to make a plan and execute. Your salespeople, your customers and your financial statement will thank you!