Aged Inventory can be your friend.....

Your oldest inventory can be holding your biggest profits in the right market.

Aged inventory historically has been our worst nightmare. The math was easy to do too. Typically, it would cost us around 40 dollars a day to hold on to a used vehicle. Depending on how long we held on, that cost could eat up our entire profit margin and then some. The only option in days past was sending the vehicle to wholesale and expecting a loss. We assumed it had to take a beating because it was undoubtedly undesirable if it couldn't be retailed. That isn’t the case. Wholesale inventory is not necessarily undesirable but let's save that discussion for another time. The point of this blog is aging inventory can be the secret to some of our biggest profits. If the old way of thinking about aged inventory is still a practice for your dealership, read on.

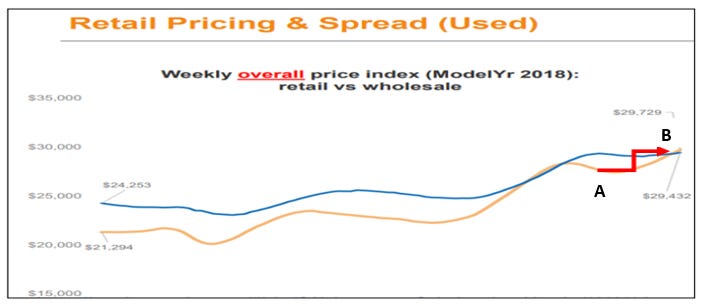

Take a look at the graph below from last week comparing the average year model 2018 used vehicles. You see the orange line represents the Manheim Index (Wholesale Cost), and the blue line is the Retail Market Index (Retail Price). The graph shows we are now in a place where the price of the acquisition (orange) is higher than the retail sales price (blue). Now that assumes you bought and sold the vehicle the same day. However, looking below again, if you bought at wholesale price “A” and sold a few weeks later at retail price “B” you realized substantial gross compared to a vehicle acquired last week that sold a few days later. This is how aged inventory can be your biggest source of profits in a market where the retail price has not caught up yet. This allows flexibility in adding sales spiffs and slight discounting to that aged inventory to incentivize the transaction and realize the gross today. LIFO (last in first out) isn’t common old-school retail practice but in this market, it can yield dividends.

In these unique times, if we think like others won't and don’t, we can take market share and the associated profits. For the last 18 months, volume-selling has not been a blanket best practice because of the inverted depreciation curve. The market has allowed every VIN to stand on its own. That dynamic has made it unnecessary to discount or rush the sale to achieve a predetermined inventory turn number or aging policy. Profits were too high to sacrifice gross for volume.

The question I get often is will this last forever. Absolutely NOT! We should keep our eye on the fundamentals and be ready for any market turn. I wrote on how to do that in my post that is dated 10/20. The point I hope to make here is in an appreciable market you will always have some aged inventory if you’re not discounting or going direct to wholesale with a hard turn policy. In the last 18 months, those have not proven to be the best strategies. If you have some aged inventory now is the time to sell that first even at a slight discount. You will make out better than selling your first in first out while waiting for the retail price to catch up. In a few weeks, the inventory you acquired today will have more profit in it than it does now.

Finally, please understand everything here is Macro-Economics not Micro. I am not suggesting you be lazy about your aging inventory approach and keep inventory without a plan. My purpose here is to help reveal what the market is showing so you can ask the right questions and be ready to take advantage of the opportunities afforded by thinking differently. You most likely have vendor partners who can look at your market, your inventory, and your business plan to help you execute a strategy that is the best fit for you. If you don't, reach out and we can get you connected with a team who can help.